Back in Pennsylvania - when I was on the School Board - I used to argue that property tax assessment should not change until a property is sold. Then the new basis for the taxes would be the selling price of the home. That is good for an owner who has been in a home a long time. Their property taxes would not go up until the house sold and in many cases that only happened when they died.

Be careful what you wish for - because Florida passed a law saying property taxes cannot rise more than 3% in any one year unless the property is sold. At that time the city or county can reassess the property.

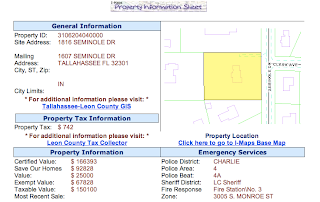

Since our present home is one of the more recently sold properties - we pay more taxes than most of our neighbors. Our home taxes are $3300 a year. Some of my neighbors pay around $2000. And the taxes on the home we bought 5 doors down the street are only $740 - because Ray - the former owner - lived there 40 years.

When we bought Ray's house for $150,000 - the assessor visited the home on the day before the sale. The current appraisal of the property was $166,000 and I am guessing our taxes will rise to $2800. That will be the basis for future tax bills. That amount can only go up 3% a year unless you do some major improvements.

Another break that homeowner's get is that $20,000 of value is exempt if you are the resident and homeowner. We will not get that on the new property because we do not live there.

So now the shoe is on the other foot. I am now in favor of all properties being assessed every 5 years - and your taxes change accordingly. Of course when I get the new assessment - I will go to the court house - and appeal to make sure the assessment is correct.

Another chance to look at life from both sides.

Remember - property taxes and sale taxes fund everything in Florida. The constitution does not allow an income tax. The sales taxes are high to wax the tourists. And when tourism is down - everything is down.